(health care) valuation bubble gradually squeezed out, the market is returning to reason."

Asked about the biggest change in China's healthcare venture capital in recent years, many investors mentioned this. They believe that after the boom of investment and IPO in the healthcare industry from 2015 to 2017, the industry will usher in a stage of reshuffle. Both start-ups and investment institutions will face the survival of the fittest, and the Matthew effect will intensify. In the end, the head enterprises and institutions will survive and develop better and better.

Since this year, the financing data of the primary market can be used as evidence. According to the venture capital database of chuangyeongbang, as one of the key VC / PE betting tracks in the first half of 2019, there were 223 financing events in the field of medical and health care in China, with a total financing amount of 32.949 billion yuan. The financing heat in this field has always been in the top three in China.

Although affected by the cold winter of capital, this data has a significant decline compared with 295 financing events and the total financing amount of 38.5 billion yuan in the same period last year, the average financing amount of each project has increased, and the funds are being collected to the head enterprises.

Yang Chao, a senior industry analyst at Huoshi Research Institute, also introduced in an interview with chuangyeong Bang: "after a shallow pursuit, capital will become one of the promoters of advanced technology. At present, the industry has entered a new era of transformation and upgrading, the trend of inclusive high growth industry is gone forever, and exclusive market competition is about to start. Enterprises with real technological innovation and model innovation are increasingly concerned by capital. "

Therefore, even though the difficulty of VC / PE fundraising has been transmitted to the project end since 2018, as a typical anti cycle industry, great health care can still go against the trend in the capital winter. With the new rules of listing and financing of biotechnology companies issued by the Hong Kong Stock Exchange and the establishment of science and technology innovation board, the IPO performance in the field of health care this year is more eye-catching. As of August 30, 2019, 18 large medical and health enterprises have completed IPO, compared with 16 in the whole year last year.

In recent years, the Internet, big data, artificial intelligence and other new technologies have given the medical big health industry more characteristics of the times, and constantly spawned new models, new industries and new formats. In 2019, chuangyeongbang listed medical health as one of the five most noteworthy racetracks. As an accompanier of innovation and entrepreneurship, we are witnessing a new stage of the development of medical health industry.

In April this year, chuangyeong Bang launched the selection activity of "top 50 Chinese medical big health innovation enterprises 2019". Through nearly five months of registration, interview, research and evaluation by judges, a total of 50 medical big health enterprises stood out and became the benchmark of innovative enterprises in the industry this year. These enterprises cover biotechnology and pharmaceutical, innovative medical devices, scientific and technological medical (Internet, big data, AI, etc.), medical services and pharmaceutical outsourcing and other sub industries, and are the leaders in their respective fields.

The following is the list of top 50 healthcare innovation enterprises in China in 2019

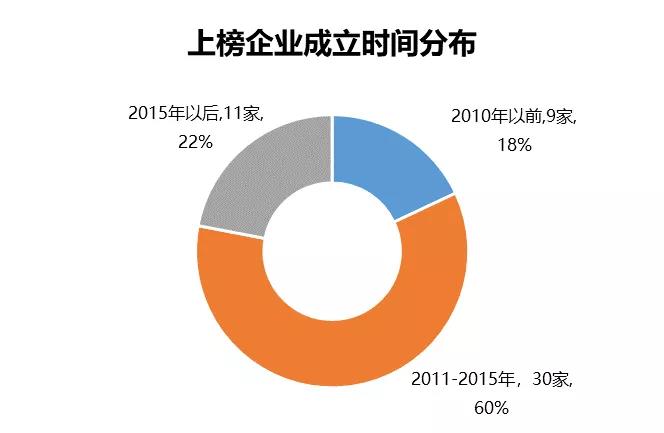

1. Time distribution of establishment

The average establishment time of 50 listed enterprises is 5.24 years, 30 enterprises were established in 2011-2015, accounting for 60%, 11 enterprises were established after 2015, accounting for 22%, only 9 enterprises were established before 2010.

After the implementation of the new medical reform in 2009, the whole market has become very active. With the growth of population aging and the development of innovative drugs encouraged by policies in 2016, the health care industry has been paid more and more attention, and a large number of enterprises have been established and grown up in this period. At present, China's healthcare venture capital environment is unprecedented, with so much capital investment and good policy support.

2. Regional distribution

The 50 listed enterprises are concentrated in spatial distribution, with the largest number of enterprises headquartered in Beijing, 18; Hangzhou, Shanghai, Shenzhen, 6 each; in addition, Suzhou and Guangzhou, 5 and 2 enterprises respectively.

As the most developed first tier cities in China, Beijing and Shanghai have natural advantages in industrial resources, talents and financing facilities. As a new first tier city in China, Hangzhou and Shenzhen, which are newly rising, have shown their advantages in policy, scientific research and entrepreneurial environment in recent years, attracting many excellent large-scale medical and health enterprises to grow.

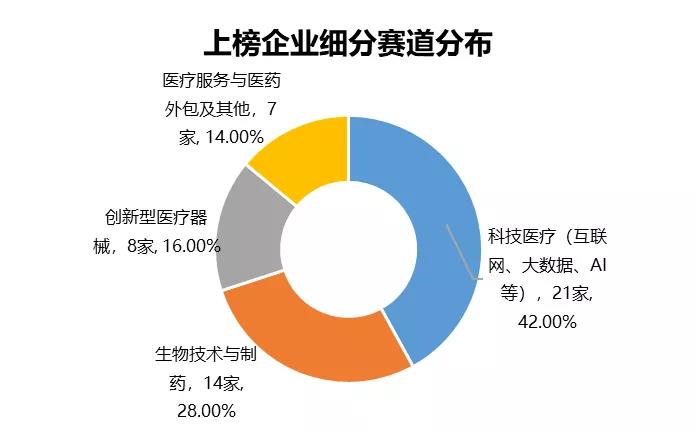

3. Distribution of subdivisions

The 50 listed companies are mainly from the scientific and technological medical industry, namely Internet medical, medical big data and AI medical, accounting for 42%; the second is biotechnology and pharmaceutical enterprises, accounting for 28%; innovative medical devices and medical services and medical outsourcing and other enterprises accounted for 16% and 14% respectively.

Since April last year, the government has issued a number of policies to encourage and promote the healthy development of science and technology medical care while standardizing the management of science and technology medical care. Key words such as "smart medical care", "big data", "informatization" and "telemedicine" have also appeared in the assessment index of action plan for further improvement of medical services (2018-2020) issued by the National Health Commission for many times. In.

Founded in 2017, Shukun technology can reconstruct digital organs such as "digital heart" and "digital brain" from medical images, which can not only automatically detect "lesions" and find "medical history", but also shorten the original single case diagnosis process of more than 30 minutes to 5 minutes, greatly improving the work efficiency and diagnosis efficiency of doctors. In February this year, Shukun technology completed a round of B financing of 200 million yuan.

In recent years, with the support of a series of national policies, the field of biotechnology and pharmaceutical industry has gradually become active. In the first half of 2019, nearly half of the financing amount of health care is invested in the field of biotechnology and pharmaceuticals, while innovative drugs are the top priority, and a large number of financing events continue to occur.

As the first ophthalmic gene drug R & D company in China, newfoss takes Leber's hereditary optic neuropathy (LHON) as the breakthrough point and uses gene therapy technology to bring light to the majority of ophthalmic genetic disease patients. At present, 159 clinical trials have been completed in newfoss, with an effective rate of 62.99% in 6 months and 63.21% in 12 months.

In the field of innovative medical devices, with the improvement of economic level, people have higher requirements for disease risk prediction and early screening. Kangliming biology, founded by Zou Hongzhi, an expert of the national "thousand talents plan", is a high-tech biological company specializing in the research and development of early cancer diagnosis products such as fecal DNA cancer detection kit. Its product "changanxin" can significantly improve the detection rate of colorectal cancer, effectively reduce the incidence of colorectal cancer, achieve early detection, early prevention and early treatment, and make a significant contribution to the health of residents.

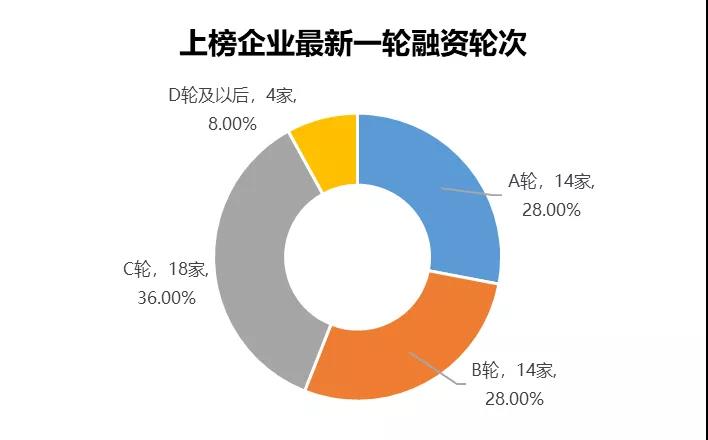

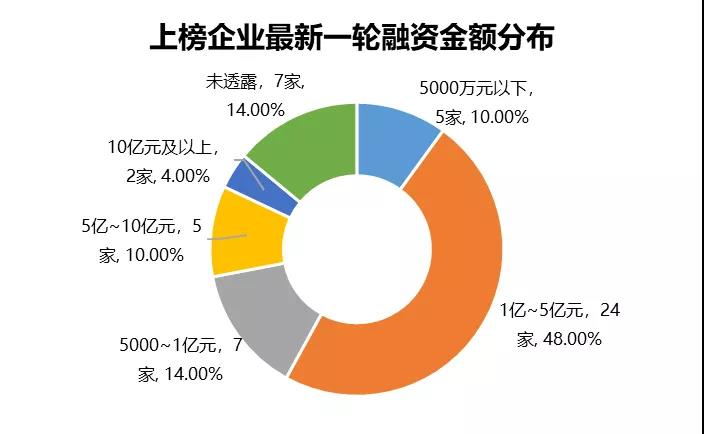

4. Financing rounds and financing amount distribution

The average valuation of the 50 listed companies is 1.983 billion yuan. The latest round of financing rounds is mainly focused on round C, accounting for 36%, followed by round a and round B, accounting for 28%; the latest round of financing amount is the highest, accounting for 48%, accounting for 24%, accounting for 10%, accounting for 4% of the total.

At present, China's population has entered an inflection point. In the next decade, the field of medical big health will usher in sustainable development. Technological innovation and import substitution will drive the rapid growth of domestic medical big health enterprises. With the medical big health industry being favored by the market and capital, large amount financing of early and medium-term projects will increase.

5. Founder's age and overseas background

The average age of the founders of 50 listed companies is about 42 years old, among which the youngest is only 30 years old. 36 founders have overseas study / work experience, accounting for 72%.

The average number of employees in 50 enterprises is 365, the average number of authorized invention patents is 13, and the average number of R & D personnel is 95. (statistics as of June 30, 2019)

Thanks to the huge market prospect in the field of large medical and health care in China, as well as the continuous improvement of China's medical policy and the upgrading of medical consumption in the past two years, driven by the national "thousand talents plan", a large number of professionals studying or working abroad have returned to China for entrepreneurship. However, compared with the developed countries such as Europe and the United States, the independent R & D ability of China's large medical and health enterprises is relatively weak, the innovation ability needs to be improved, and the industrialization experience needs to be accumulated. Therefore, to catch up with the developed countries in Europe and the United States, more returnees and talents with international vision are needed to join in.

source: Chuang Ye Bang